Assessing Value

Along with pulling what you define as your organization’s potential EHS&S challenges and considering OSHA’s hazard categories, such as Biological, Chemical, Ergonomic, Physical, Safety, and so on, it is essential to also assess the value that a HSE&S solution will bring to your organization by resolving hazards, monitoring proactively and preventing problems at early stages.

Ideal “To-Be” Scenario:

Although it’s very complex to assess what value a EHS&S solution can bring to your organization specifically, I will attempt to spell out generic types of value drivers that could help ignite the thought process here:

Based on the specific challenge and respective hazard identified, it’s obvious that your organization has certain expectations for what a EHS&S solution should deliver. Tracing the high-level requirements of the solution can be your first driver.

The breadth of functions and it’s the solution’s capability to address and mitigate the risks.

How your organization’s reputation can be kept intact without any damages incurred due to the hazards that we discussed earlier, not just in the immediate but also in the long term.

Not only the product itself, but also the level of services and warranties that can be provided by the EHS&S solution vendor.

How much trust and confidence in mutual success the EHS&S solution vendor inspires.

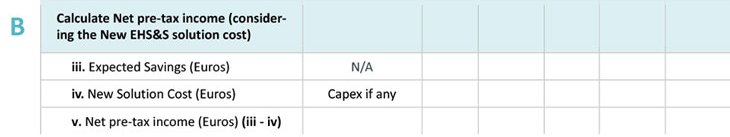

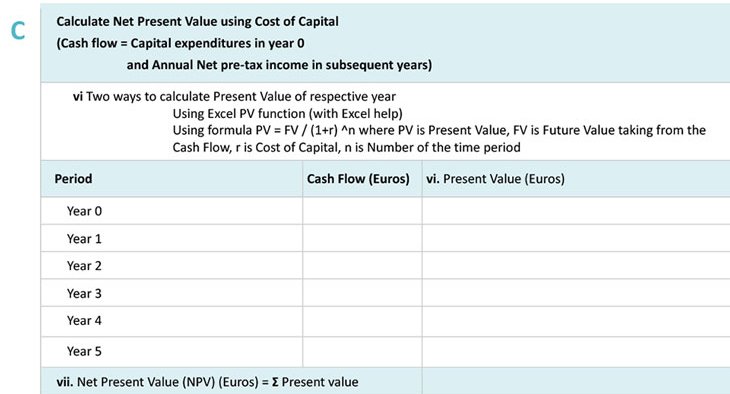

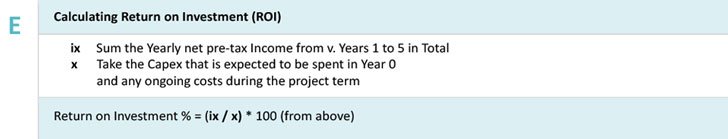

Now that the value drivers have been hashed out, the business and technical requirements also need to be drafted. So, we as the EHS&S solution vendor can work on the cost of the respective solution including implementation. By this first step (let’s call it “New Solution Cost”) we will have the estimated total cost of your new EHS&S solution, including the value that it will add.

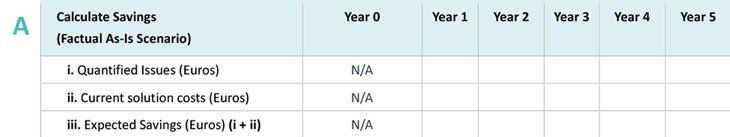

Factual “As-is” Scenario:

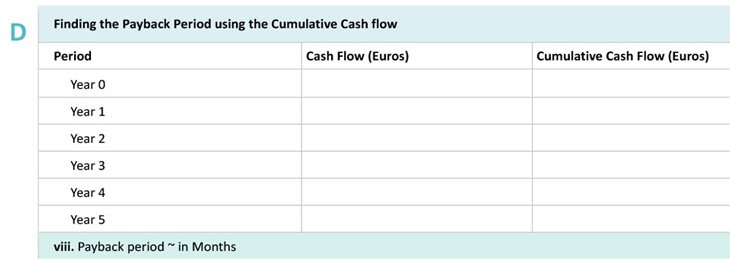

Beyond understanding the new solution cost, it is obvious to understand the financial consequence to the whole investment. Note that, like the value drivers can be different to different organizations, the same applies for the financial aspect.

It’s very important to understand the cost of the systems & processes that are in place today (could be Excel or any other standard solution). You should also consider the scenario of you having no solution currently.

Quantify the issues that you are facing with current systems and processes. Don’t just consider Total Cost of Ownership of such systems, but also note the impact of:

Incidents you are unable to manage

Situations which made your organization vulnerable due to non-compliance

Low engagement and higher employee attrition due to the risks that they could face

Ad-hoc scenarios leading to hazards

Inability to bring your products to market on schedule due to these issues

Unhappy customers who are wary of buying from a risk-prone organization

Competition having an advantage due to a lack of ability to compete effectively in the market

All the negative numbers you accounted so far due to these issues

Through this step (let’s call it “Expected Savings”), we will have total costs of your current systems & processes including the issues quantified monetarily. Thus, we can derive the savings that will be realized during the operational Ideal “To-Be” Scenario.